Types of Derivatives

While there is a wide array of derivative structures, the new regulation allows for credit unions to utilize only specific interest rate derivative instruments. Allowable structures include:

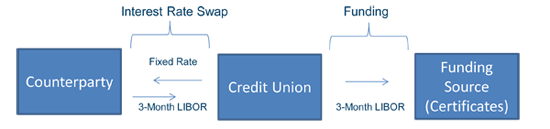

Interest rate swaps – Agreements between two parties that allow an exchange of interest payments based on a notional amount through a set maturity date. A traditional swap converts a floating rate obligation to a fixed-rate. A reverse swap converts a fixed-rate obligation to a floating rate. This type of hedge, called a plain vanilla swap, is commonly used to convert a floating rate obligation to a fixed rate or to convert a fixed rate obligation to a floating rate obligation.

Basis swap – Agreement wherein the counterparties exchange cash flows from two different floating rate indices, thus mitigating the risk of spread changes between the two interest rate indices.

Interest rate cap – Agreement between the seller of the cap and the buyer, wherein the buyer's floating interest rate exposure is limited to a specified level, known as a strike rate, for a specified period of time. This "cap" protects the buyer against rising interest rates.

Interest rate floor – Designed to protect the buyer from losses resulting from a decrease in interest rates, the agreement provides for compensation to the buyer when a specified interest rate falls below the floor’s strike rate.

U.S. Treasury note futures – Allow credit unions to purchase the obligation to buy or sell a Treasury note on a specified date in the future, thus offsetting the impact of declining or rising interest rates.

Derivative strategies can utilize forward dates of up to 90 days. These include plain vanilla swaps, amortizing swaps, interest rate caps, and interest rate floors.

For more information about the Derivative Hedging Services or any of the customized investment solutions offered by Catalyst Strategic Solutions, contact us at 800.301.6196.

"Catalyst" is a brand name for the financial services business conducted by Catalyst Corporate Federal Credit Union ("Catalyst"), both directly and through its subsidiaries, including CUSOURCE, LLC, d/b/a Catalyst Strategic Solutions ("CSS"). Balance sheet management services and asset liability management services are offered through CSS, a SEC registered investment adviser. CSS is a separate entity from Catalyst and all investment decisions are made independently by CSS employees. Neither Catalyst nor CSS provide its clients with legal, tax or accounting advice.