By John Kirby, Investment Officer

As we enter the eighth month of the pandemic, credit unions that have consistently maintained a short-term investment strategy may be starting to see their investment income levels drop as they complete their 3rd quarter call report. We’ve already seen net interest incomes drop since the market crashes this spring, as the zero-interest rate environment leaves less room for net spread between cost of funds and what you’re earning on assets.

As we enter the eighth month of the pandemic, credit unions that have consistently maintained a short-term investment strategy may be starting to see their investment income levels drop as they complete their 3rd quarter call report. We’ve already seen net interest incomes drop since the market crashes this spring, as the zero-interest rate environment leaves less room for net spread between cost of funds and what you’re earning on assets.

Prior to the spring crashes, cash positions were paying well enough that a short-term strategy made sense if your loan demand was strong. Flash back to the inverted yield curve of 2019. Inverted yield curves have preceded seven of the last eight recessions and typically indicate it may be time to consider adjusting your investment strategy.

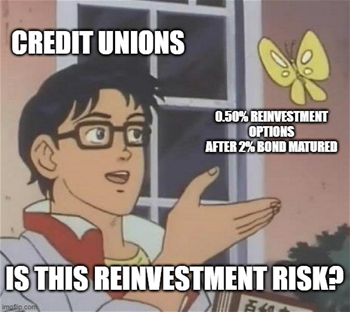

What we’re seeing currently on credit union balance sheets is another reason to consider that change. All the short-term investments bought by credit unions the last few years are starting to roll off their balance sheet. Unfortunately, longer-term investments with higher coupons and yields are maturing at the same time. Many credit unions are seeing their two- or even three-percent coupons roll off, leaving them to reinvest at today’s low rates.

Therein lies the rub or, reinvestment risk. Strategically speaking, as soon as the yield curve inverted, portfolio managers should have considered moving farther out on the yield curve with a portion of their investable assets to lock in those yields for the long term. According to the Federal Open Market Committee (FOMC), we’re now facing a 3- to 5-year period, at least, of near-zero rates. That means reinvestment risk hasn’t gone away. Any credit union investment under three years will likely, at maturity, be reinvested at the same low rates.

Implicitly, meeting your liquidity needs should be the primary focus of your investment portfolio. There isn’t much benefit in committing to a 5- or 6-year term to lock in a yield if you’ll be needing that cash for loans, or otherwise. Subject to liquidity needs, credit union investors should consider using their available cash to invest further out on the curve to try to catch interest rates as they begin to rise again.

Unfortunately, we don’t have a crystal ball. After the last recession, it took the FOMC seven years to raise rates again, so the 3- to 5-year timeline may not be an accurate depiction of when rates will increase in this scenario. What we do know is that cash is likely to continue paying next-to-nothing over that timeframe, and investment income will only continue to fall as seasoned, higher-yielding investments continue to mature or pay down.

If your credit union has typically been a short-term investor, but you’ve seen a drop in loan demand, consider moving farther out on the curve to lock in some of the better yield options available now. Your balance sheet might thank you in 3-5 years.

If you would like to learn more about adjusting your investment strategy, Catalyst Corporate’s seasoned brokers are happy to compile a portfolio analytics report to aid in your planning efforts. For more information, contact us today.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.