By Karen Coble, Vice President of Sales

I am a fan of infographics. Perhaps you are, too.

In a world saturated with big data and long communication threads, infographics seem to me a welcome snack: bite-size and easily digestible nuggets of information.

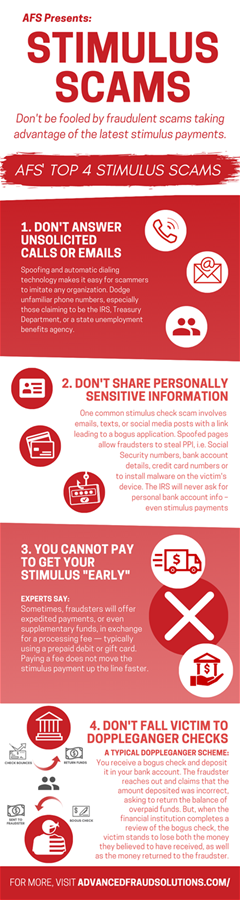

So I was pleased when I came across a recent infographic from Catalyst Corporate’s newest service provider – Advanced Fraud Solutions (AFS). The helpful infographic highlights preventive measures members can take to avoid a recent trend – stimulus check fraud.

As AFS pointed out, stimulus check scams were prevalent last year. Since January 2020, Americans have lost almost $300 million to COVID-19 and stimulus payments-related fraud, according to a report from the Federal Trade Commission. That agency also received more than 316,000 complaints with the median fraud loss at just over $300.

The Internal Revenue Service let Americans know they could expect to receive stimulus checks via three delivery methods: a direct deposit into an account, payment cards or paper checks. Nevertheless, criminals used stimulus-themed emails and text messages to trick consumers into providing personally identifiable information and bank account details.

With the third round of stimulus checks being delivered to millions of Americans this summer, AFS created the infographic (shown below) to help credit unions remind their members how important it is to remain vigilant against fraud attempts.

Unfortunately, stimulus check fraud is not the only type of check fraud.

As technological advances and digitized payments evolve, so do methods of check fraud. So says a new AFS white paper: The Changing Landscape of Fraud.

According to that white paper, check usage continues to decline steadily but still represents a significant portion of payment volumes.

Check fraud tactics, bolstered by access to new technologies and software, have made fake checks cheaper and easier to produce. Consequently, checks remain a frequent and lucrative target of payments fraud.

An example of a fraud scheme using checks is the deployment of doppelganger checks. Typically, this scam starts when a recipient receives a bogus check and deposits it in their bank account. The fraudster then reaches out, claiming that the amount deposited was incorrect, and asks the recipient to return the balance of overpaid funds. But, when the financial institution reviews the check and determines it is a counterfeit, the victim stands to lose both the money they thought they received, as well as the money returned to the fraudster.

To ensure their check fraud prevention strategy is effective, credit unions should focus on every point of presentment. Without an adequate front line or remote check fraud protection solution, fake checks can be nearly indistinguishable from real checks.

As a result of Catalyst Corporate’s collaboration with AFS, credit unions now have access to TrueChecks® – a robust check fraud detection tool.

TrueChecks scans deposited check data against a database with more than 10 years of historical data from thousands of banks, credit unions and processors. This database seamlessly integrates with any existing system and offers real-time responses on duplicates (effective against double presentment ploys), counterfeits, non-sufficient funds (NSF), and closed accounts, which helps reduce manual workload, manager intervention and check fraud losses.

TrueChecks has been well-received by credit unions. See what some of them have to say. If you want more information on TrueChecks, you can schedule a meeting or request a demo with one of our product experts.