By Paul Shorkey CFA, FRM, Catalyst Strategic Solutions ALM Consultant

On February 28, 2024, the NCUA released stress test scenarios to ensure larger credit unions can continue safe and sound operations in the event of a severe recession. The stress test targets credit unions with assets greater than $15 billion, the threshold at which annual stress tests are required. In practice, however, many credit unions begin running the annual tests as they near $10 billion in assets. This helps them become familiar with the process – testing and validating their assumptions, navigating the reporting timeline and educating management, ALCOs and boards on the process.

The stress test scenarios include measures of overall economic activity, asset prices (i.e., home and commercial real estate values), inflation and interest rates. The scenarios for 2024 (consistent with 2023) include a Baseline and a Severely Adverse scenario, but credit unions are also encouraged to create internally designed scenarios based on their unique market and member segment. For instance, a credit union in a largely agricultural region may want to explore an extreme weather event and the associated impacts on local economic factors with such an event.

2024 scenarios

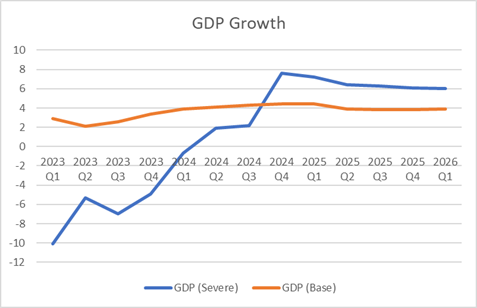

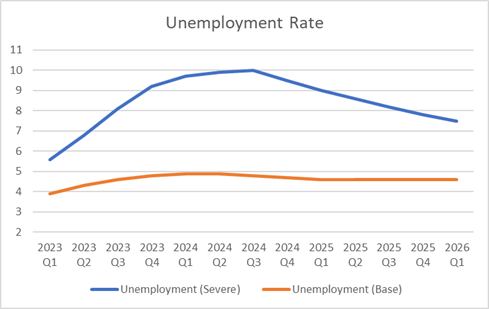

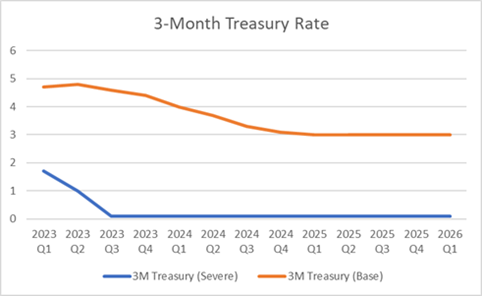

The 2024 stress test simulates potential adverse economic conditions due to high inflation, high interest rates, deposit volatility and recession risk. In the 2024 projected Severe Adverse Scenario:

- Real GDP declines significantly through the first quarter of 2025, before recovering.

- Unemployment rises by 6.5%, to 10% in the third quarter of 2025.

- Inflation falls from 2.8% CPI to 1.3% in the third quarter of 2024.

- The 3-month U.S. Treasury (UST) rate falls significantly to 0.1% by third quarter 2024 and remains there.

- The 10-year UST rate falls 3.7% in the second quarter of 2024, then gradually rises to 1.5%.

- Corporate bond spreads widen considerably to 5.8% over the UST rate in the fourth quarter of 2024, and then gradually narrow to 1.6%.

- The home and commercial price indices fall sharply through the third quarter of 2025.

- Equity prices fall 55% throughout 2024 and do not recover until the end of the stress test horizon.

In contrast, the 2024 projected Baseline Scenario simulates steady economic conditions, with economic factors reverting to the average over the horizon.

.png?sfvrsn=e09382a1_0)

Credit loss models

The essence of the stress test is to examine the impact of the proposed economic scenario on the credit union’s expected loan losses and the impact to capital, relative to its assets. The scenario time horizon calls for a 9-quarter projection, and the resulting net interest income (NII) and the provision for loan loss is observed relative to the credit union’s asset level. The goal is to clearly demonstrate that the credit union has sufficient capital to withstand the expected credit losses implied by the proposed economic scenarios.

Most credit unions rely on their ALM model to project NII, while the loan loss provision projection is based on statistically driven credit loss models (for each distinct loan type) that project the probability of default (PD) and loss given default (LGD).

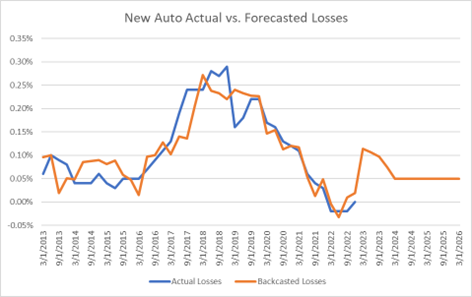

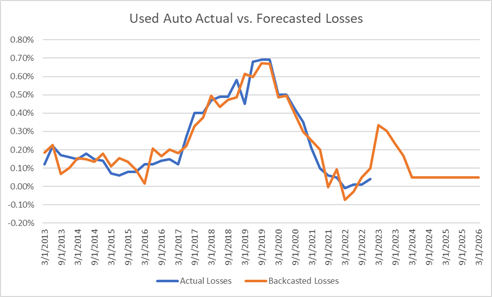

Testing of these loss models is also expected as part of the modeling assumptions and justifications. Catalyst encourages credit unions to demonstrate the predictive power of their loss models by backcasting the models relative to actual historical loss experiences. Below is an example of fitting a credit loss model against historical data to justify the predictive power of the models employed.

Time is ticking away

While the NCUA provided the scenarios on February 28, covered credit unions are required to complete the modeling scenarios by May 31. If the test illustrates that the credit union’s net worth ratio falls below 5.0% in the simulation, the credit union will be required to prepare a capital plan that, then, must be accepted by the NCUA.

The clock is already ticking. Make sure your stress testing process is sound, and secure partners to assist as needed. If your credit union is at or approaching $10 billion in assets, Catalyst’s Risk Management Team has the skills to support you. We can outline options for an integrated stress testing solution that includes building credit loss models, running scenarios and helping management develop custom scenarios relevant to your unique market footprint.

Contact Catalyst Strategic Solutions’ ALM Service today to schedule a time to discuss your options for an integrated stress testing solution.